Bringing You Payment Insights, Trends and Best Practices

All posts by Louise May

Bringing You Payment Insights, Trends and Best Practices

Bringing You Payment Insights, Trends and Best Practices

Internet gods!

I can hardly believe it. Here I am, the last person in the world to know anything about social media. I am guided step-by-step in this process of providing little tales about my experiences and, low and behold, I have already offended the internet gods! Facebook has found last week’s blog offensive enough to deserve its censure. Well, at least their new regulations require me to prove that I am who I claim to be before I can use any paid advertising. (See explanation note below.)

As it happens, on the very day you may have read my last blog, I was reading a US newsletter, Pymnts.com, that described a decision by a South Dakota court that individual US states could assess taxes on the very online sales companies that Canada is planning to tax. So does Facebook feel my blog should not be promoted beyond its current modest readership?

So does Prime Minister Trudeau intend to honour his election promise and join the US so Canada can also tax these freeloaders? Politics can create strange bedfellows but Americans need to elect better presidents before we will throw in the towel on that matter. Besides where would the US find a state among its 52 states, that is more docile than Canada?

Kidding aside, it is really an affront to our intelligence for those companies to think they should be allowed to operate tax free in any country they choose to do so. Maybe we should revisit that Trans Border Data Flow issue again.

With Cyber Monday coming up and consumer online sales expected increase over 400% from any other Monday, its good to think about how this economy is taking advantage of our country’s slack tax laws. This year it might even be a bit worse as the exchange rate favouring Canadian retailers so we should be the ones to attract more American business.

If you are thinking about shopping online for Cyber Monday or online shopping at anytime please also see Online Safety Tips written by Telpay IT Systems Manager Jack Slawik: https://blog.telpay.ca/online-safety-tips/

NOTE:

According to Facebook:

“Ads about social issues, elections or politics that appear on Facebook or Instagram should include a disclaimer provided by advertisers that shows the name of the person or entity that paid for the ad. This is a list of top-level issues that will be considered in determining which ads targeting Canada require authorization and disclaimers: civil and social rights, economy, environmental politics, health, immigration, political values and governance, security and foreign policy.”

Disclaimer: So to make it clear, I, W.H. (Bill) Loewen through my company Telpay, am paying for this Facebook account and any ads that appear here.

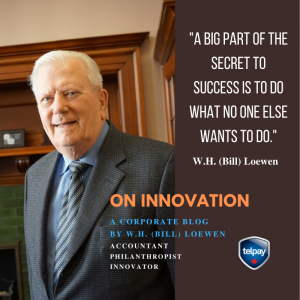

“On Innovation” is a corporate blog by W. H. (Bill) Loewen, founder, Comcheq Payroll Services and Telpay Bill Payment Services, exploring the impact of current innovations in the financial services industry and reflections from his past 50 years of business experience. In his spare time, Bill likes to spend time with family and friends, play bridge, dabble with woodworking and is a passionate classical music lover.

Bringing You Payment Insights, Trends and Best Practices

Online Safety Tips

Online Safety Tips

We’ve all heard the best tips for staying safe online . While strong passwords , antivirus software and firewalls are a good start , here are 3 not so common tips that will help protect you and your data online.

Enable Two-Step Authentication where available

Also known as multi- or two-factor authentication or login approval – two-step verification provides an extra layer of security beyond your username and password to protect against account hijacking. When using this security mechanism, you will log in using your password and then be prompted verify your identity again. This second verification is usually done by receiving a security code to your mobile device.

Many websites and companies offer two-step verification, and they make it easy to set up this second layer – usually found in the settings section of your account. Using two-step authentication can help you feel more secure, especially for sites containing your financial information.

Check a Site’s SSL Certificate

Whenever you’re shopping online and entering credit card or bank information, it’s important to make sure that website is secured to protect against hackers trying to steal your info. You can find out if a website is secure by checking its SSL (Secure Sockets Layer) certification. While this process sounds complicated, it’s actually one of the simplest and quickest things to do for your online security.

When on a website, check the URL. Does it start with “http://” or “https://”? If you notice an s at the end, that means your connection is encrypted and secure, so any data you enter is safely sent to the website. Not all sites have SSL certification. While they may be fine to browse, avoid sharing any financial or personal information on websites without this added layer of security.

Don’t Save Financial Information on Shopping Sites

Even sites with SSL certification can be hacked. While there may not be a way yet to completely safeguard your data from hackers if you shop online, you can secure your financial information better by removing it altogether from shopping sites.

Many shopping sites let you save your credit card information in your online account. This setup makes it easier to make purchases in the future, as your billing and shipping addresses and credit card information are stored. However, if you can access this information, so can hackers. Rather than store your credit cards and addresses in your accounts, spend the extra minute to enter your information each time you make a purchase.

Jack Slawik, IT Systems Manager

Bringing You Payment Insights, Trends and Best Practices

An Echo from the Past

Last Saturday, the Globe and Mail ran an article about large American firms lobbying the US government to discourage the new Canadian government from keeping its election promise to raise income from internet service providers who earn income from their users in Canada. (U.S. business groups claim Ottawa’s digital tax plan could imperil USMCA, ask White House to intervene, Nov. 16)

It took me back to to the 1970s and 80s when a phenomena called Trans Border Data Flow (TBDF) was a bit of a hot potato. Data processing service bureaux were thriving at that time, at least in terms of investment. Datacrown, Canada Systems Group, Computel and others with backers such as Crown Life, Stelco, Eaton’s and so on. They were boasting how they were going to grow into the lucrative US market. They had an industry association called CADAPSO – Canadian Data Processing Services Organization. I had lead a group of small firms by forming CICS – Canadian Independent Computer Services, in an effort to stop banks from moving into the data processing field. The two groups became rivals. I recall a dinner put on by the Ontario government to which I was invited as were many heads of the large data processors. We each had to introduce ourselves. The head of CADAPSO boasted that his organization represented 90 per cent of the revenues generated by the Data processing industry. I desperately wanted to say that our organization represented 90 per cent of the profits of the industry. As an out of town guest I felt I should mind my manners and passed the opportunity. It wasn’t that long until they had all disappeared and, as it happened, so did all their parent companies.

At the same time the Canadian telephone companies were building cross border communication facilities to make it easier to move data across the border. As described by a friend of mine “We have built the highways for our conquerors chariots”.

Some Canadians have long been concerned about the high degree of foreign investment in Canada. I had thought the data processing industry, being new and Canadian-owned at that time, should remain an exception to the many industries that were foreign-owned. Some of us tried but failed. Even when selling Comcheq I turned down an offer from ADP and sold to CIBC on terms that I hoped would see Comcheq remain Canadian-owned. I thought the banks were in the payroll business forever. How naïve I was! At the very first opportunity, CIBC sold to a US firm.

The federal government had, some time earlier, passed the Foreign Investment Review Act. Under that act, all larger corporations had to provide their annual Canadian financial statements. With that information it was easy to see the degree of control and even profits of foreign-owned businesses. Even then it was apparent that American-owned companies had higher levels of employment per million dollars of revenue in the US than in Canada. With open borders for movement of data there were many more opportunities to provide head office functions on one side of the border, exactly as the opponents of TBDF had predicted.

Today, US firms dominate the internet. Not only do they want all the resulting jobs, they want the revenue they generate in foreign countries to be free of any taxes imposed by those countries. Local companies such as Telpay generate employment, pay taxes on their profits and collect taxes on their sales and, for my part, I am happy to do so. To paraphrase Mae West, “I have not had to pay taxes and I have had to pay taxes. Paying taxes is better.” These US companies want none of that. They want a free ride in Canada. Any bets on whether they will get it?

Today’s mantra is cloud processing. Probably 90 per cent or more of Canadian cloud processing is done in the U.S. Where we go from there is anyone’s guess. Those of us who believe that sovereignty matters, have lost a lot of battles. Have we also lost the war?

“On Innovation” is a corporate blog by W. H. (Bill) Loewen, founder, Comcheq Payroll Services and Telpay Bill Payment Services, exploring the impact of current innovations in the financial services industry and reflections from his past 50 years of business experience. In his spare time, Bill likes to spend time with family and friends, play bridge, dabble with woodworking and is a passionate classical music lover.

Bringing You Payment Insights, Trends and Best Practices

The Garbage Collector

In the early days of the computer era, there were lots of predictions about where these new devices would lead us. Many are memorable because they were wrong. Someone wrote a book titled “The End of Work”. For some of us that don’t seem to have worked.

In the early days of the computer era, there were lots of predictions about where these new devices would lead us. Many are memorable because they were wrong. Someone wrote a book titled “The End of Work”. For some of us that don’t seem to have worked.

Comcheq drew predictions from others in the computer services businesses. There was no way Comcheq was supposed to be able to survive with the banks as its competitor. We were viewed as the garbage collectors of the computer industry because we provided a service no one else wanted to. But survive we did and eventually thrived because the banks who provided other types of services disappeared long before Comcheq was sold to CIBC.

A big part of the secret to success is to do what no one else wants to do. It turned out that even the banks found out that they didn’t want to do payrolls and for a couple of reasons: it interfered with their processing of their banking information and it took too much of their programming resources to maintain their system

A second key factor is to know what you are doing. Having first-hand experience in the whole cycle of the payroll operation, week by week, year by year, was instrumental. I wasn’t guessing at what customers needed. A third component necessary for success is the willingness to learn. I also learned to listen to the customer when I lost one of our first customers for not doing so. There were endless variations in customer’s needs that could be satisfied once you had the data needed to do it.

I spent a lot of time listening to customers and to employees that had listened to customers. I developed a rule that if I heard a request once, I would make a note. If I heard it twice, I looked for a solution.