Summer is short, and every moment spent inside is a moment you could have spent outdoors in the sun, capturing memories! We want to help you take your summer back.

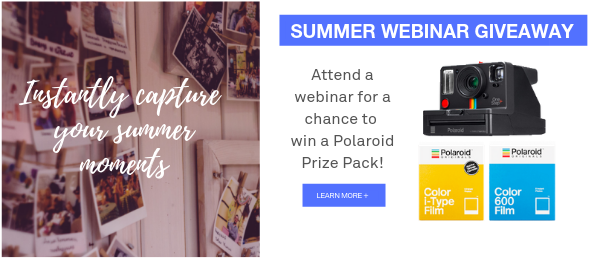

This summer, during the months of July and August, when you sign up and attend a Telpay Webinar, not only will you learn how Telpay for Business can reduce time spent indoors administering, sending, and approving payments, but you will also be entered for a chance to win a Polaroid Prize pack!

With Telpay’s all-in-one payment system, Telpay for Business can help you streamline and manage all your business payments, saving you time that you can spend enjoying summer!

With a webinar you will learn how to:

- Pay employees through direct deposit, with integration from major payroll systems, plus any system that has the ability to generate a payroll file.

- Pay suppliers, vendors, consultants, utility bills such as phone, hydro, and credit cards.

- Make CRA payments and government remittances with approved payment details.

- Send payments overseas with our International Payments

- Make USD payments from a Canadian USD bank account with the USD Payments

- Use the Remote Authorization feature built right into our software to approve payments from virtually anywhere!

Instantly recapture summer this year, by signing up for a Telpay Webinar! From July to August, we’re giving away one (1) Polaroid Prize Pack each month.

To enter, register and attend any Telpay Webinar during July and August and you’ll be entered into the monthly draw. The more webinars you attend, the higher your odds of winning!

View Webinar Schedule to Register

——————————————————-

Giveaway Rules, Terms, and Conditions

– The Contest is open to Telpay for Business Customers and ASP Partners only.

– All entrants must be 18 years of age or older.

– You will receive one entry per FULL webinar attended.

– Winner will be contacted via the email or phone number used to register for a webinar.

– The prize is non-transferable. No substitution or cash equivalent of prize is permitted.

– There is no limit to the number of webinars you can register and attend, however, you cannot win more than one prize in the same contest.